“We are what we repeatedly do. Excellence, therefore, is not an act but a habit.”

Aristotle

2020 will be remembered for many reasons. In the context of Alphacution’s ongoing research focus, we want to remember 2020 as the first full year of enhanced transparency into the mechanics and impacts of the long-held practice of payment for order flow (PFOF). Due to a convergence of factors for which most market observers are aware – such as when an emerging frictionless and highly gamified retail trading framework (which began in October 2019) collides with a pandemic lockdown, a deluge of helicopter money from the Fed, and the growing influence potential of social media tools – PFOF became a critical driver in US listed markets, mainly cash equities and equity options. In other words, enhanced use of PFOF as the linchpin in a new zero-commission brokerage framework for retail investors (pioneered by Robinhood) sets a series of dominoes in motion that ultimately influence, to some degree, all stakeholders and all products in US listed markets.

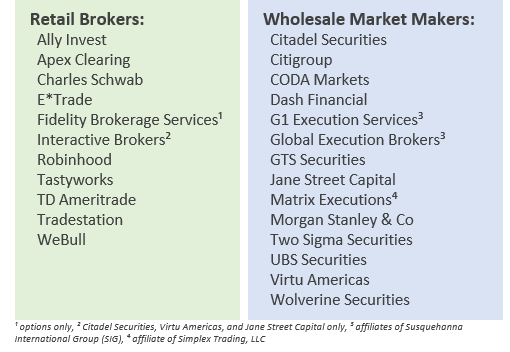

Because of this key role in the market ecosystem, Alphacution wanted to take time to explore – in as much detail as is practical – the full year of PFOF data provided by the quarterly Form 606 reports filed by retail brokers before moving any further into its research agenda for case studies because we expect a deeper understanding of PFOF to be useful for the study of market macrostructure. Now, relative to Alphacution’s library of published case studies (which have typically focused on affiliated entities to a single trading firm), this one is uniquely ambitious for its scope of modeling and analysis across 11 retail brokers (comprising 12 entities) and 14 wholesale market makers (representing affiliates of 3 banks, 8 proprietary trading firms, and 2 independent agency brokers), listed as follows:

Furthermore, rather than delay all findings until the full case study is published, we thought to experiment by sharing a subset of key exhibits in the interim. Note: The following exhibits are presented without commentary. All commentary will be reserved until the full case study is assembled and published. And the following exhibits may be subject to amendment without notice in the final version of the case study.

That said, after a series of overview charts to frame the subject matter, there are 15 heatmaps in this presentation that showcase order routing rates paid by specific wholesale market makers to specific retail brokers. This collection is segmented into 5 heatmaps for each of 3 securities groupings in 606 reports – namely, S&P 500 stocks, non-S&P 500 stocks, and options. Each grouping contains a heatmap for each of 4 standard order types – market orders, marketable limit orders, non-marketable limit orders, and other order types – plus one heatmap for each securities category that illustrates the overall weighted average rates paid / received across all order types.

Lastly, each heatmap is organized horizontally by ranking retail brokers by the weighted average rate charged / received and each block in each heatmap is organized vertically by ranking wholesale market makers by total payments made in that securities category-order type pairing.

With all that in mind, the picture illustrated here is of a retail-focused corner of the market ecosystem where 2020 PFOF economics were heavily weighted toward 4 retail brokers (89.7% PFOF); 4 wholesale market makers (85.0% PFOF); securities with wide bid-ask spreads – as in, mainly options (60.9% PFOF); and, focused on two types of limit orders (65.4% PFOF). Alternatively, nearly half of total 2020 PFOF economics (45.4%) are attributable to limit orders in options. Taken together (along with the exploitation of disparities between dark and lit liquidity venues), in 2020 this corner demonstrated an unprecedented ability to influence the strategy selection and risk management of the entire market ecosystem and shifted the competitive landscape further in favor of proprietary trading firms wielding industrialized technologies and advanced caches of intellectual property…

The question to be contemplating now about all of this: To what end?

And: Are option market stakeholders bullish on PFOF if it solidifies dominance by two market makers?

The full presentation is available to premium subscribers here.

Until next time…