“While entities such as GameStop, Melvin Capital, Reddit, and Robinhood have garnered a significant amount of attention, the policy issues raised by this winter’s volatility go beyond those companies. Instead, I think these events are part of a larger story about the intersection of finance and technology.”

Gary Gensler – Chair, Securities and Exchange Commission

A Regulatory Outlook for Off-Exchange Market Makers in the Aftermath of the GameStop Hearings

By Stanislav Dolgopolov – Chief Regulatory Officer with Decimus Capital Markets, LLC and a contributor to Alphacution

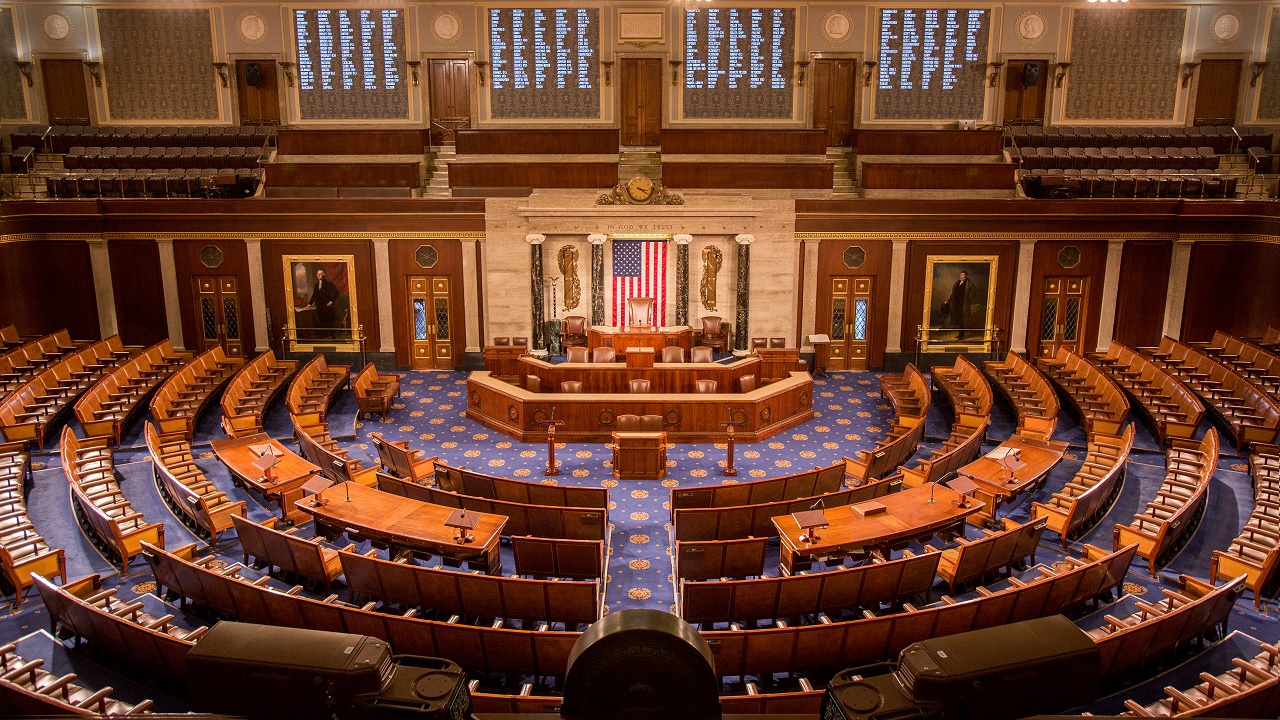

The House and Senate hearings following the infamous GameStop / meme stock / Robinhood episode of late January could be described as a cocktail of broad philosophical concerns mixed with a multitude of details relating to securities markets. On one hand, the legislators, regulators, industry representatives, and experts had articulated and debated such issues as the “gamification of trading,” “democratization of finance,” market integrity, industry concentration, and even specific projects that the touted financial transaction tax might pay for. On the other hand, the list of technicalities relating to the business model of off-exchange market makers, also known as wholesalers or internalizers, was even more impressive for such a high-level forum as the U.S. Congress.

Not surprisingly, the sheer significance of these market players for the equities space and their order flow arrangements with Robinhood and other leading customer-facing brokers have not remained unnoticed during the hearings. The laundry list included the pros and cons of zero-commission trades for retail investors, the practice of payment for order flow (PFOF), the multiplicity of roles of off-exchange market makers and their informational advantages, potential tweaks to the tick size regime, the tradeoff between the respective amounts of PFOF paid to customer-facing brokers and price improvement provided to customers, enhanced disclosure of order flow arrangements, odd-lots, execution speed, proper benchmarking for executing customer orders, and, as recently discussed on Alphacution, the significance of stop-loss orders.

Critically, the following emphatic statement was made on behalf of a leading off-exchange market maker during the hearings: “Citadel Securities owes a duty of best execution for every order that comes from Robinhood. And I will tell you that I’m incredibly proud of how seriously my team takes that duty of best execution.” This statement is a perfect illustration of the applicability of the duty of best execution to multiple parties in the execution chain—not just customer-facing brokers—which may stem from (i) an explicit voluntary assumption of this duty, (ii) the existence of a broad agency / executing broker relationship in the context of order flow / order handling arrangements, or, perhaps most importantly, (iii) the reach of the regulatory framework provided by the Financial Industry Regulatory Authority, Inc. (FINRA). Indeed, as discussed in my recent article on the best execution obligations of off-exchange market makers, this multifaceted issue, while often sidestepped, is of great importance and likely to attract the regulators’ further attention.

In addition to such scrutiny of the best execution practices of off-exchange market makers that might lead to additional enforcement actions, it is worth considering potential regulatory changes affecting this segment of the securities industry. Notably, the SEC is looking to “examine the effects of certain firms receiving payment for access to their order flow to determine, among other things, whether these practices are properly and thoroughly disclosed and fully consistent with best execution obligations.” The regulators’ focus on PFOF is not a novel exercise, as it had been undertaken several times in the past, but a redo is certainly merited in light of the new environment. As an illustration, the recent emergence of the business model based on zero-commission trades has created new distortions in the landscape; magnifying conflicts of interest created by PFOF and even leading to explicit disclaimers of best execution by some customer-facing brokers that pointed fingers at off-exchange market makers. However, a blanket prohibition of this business model or the very practice of PFOF might end up eerily reminiscent of the pre-“Mayday” era (that’s May 1, 1975) with its regulatory policing of minimum commissions and “Byzantine” commission-sharing practices. In that respect, the experience of the European regulatory regime centered around MiFID II, which otherwise essentially prohibits PFOF, shows that PFOF-like arrangements involving both on-exchange and off-exchange market makers and customer-facing brokers could be concealed via bundled products or intermediated by other parties, such as trading venues. Interestingly, the hearings have covered the now famous comment letter by Citadel urging to ban PFOF in the options space back in 2004, which could be added to another contemporaneous comment letter by the same firm criticizing internalization in the equites space likewise cited by its own critics.

In fact, one of the proposed legislative solutions would prohibit all forms of PFOF by off-exchange market makers and securities exchanges alike, which amounts to banning various inducement programs, including maker-taker arrangements, and thus upending the entire securities industry. Moreover, another proposed legislative fix would penalize, specifically with respect to market makers, the already outlawed practice of “trading ahead” in light of a recent enforcement action by FINRA and the controversial theory of potential front-running of customer orders by off-exchange market makers based on aggregated information from stop-loss order books. Notably, this proposed solution includes Sarbanes-Oxley-style CEO certification and compensation clawbacks without any mention of the unit segregation / “no-knowledge” safe harbor as a key feature of FINRA Rule 5320. The bluntness of these proposed fixes makes it more likely for any future changes to be put into effect by the regulators rather than the U.S. Congress, although direct (and perhaps more nuanced) legislative action cannot be ruled out. In any instance, it is a promising sign that Gary Gensler, the new SEC Chairman, has been upfront about his agenda to examine such key issues as the link between PFOF and best execution, the existing concentration in off-exchange market making – and thus equities markets overall – including informational advantages enjoyed by these market players.

One specific proposal referenced during the hearings amounted to passing on PFOF directly to customers. However, this measure’s implementation appears problematic in terms of allocative calculations and the underlying methodology, as well as accounting for the overhead costs of customer-facing brokers. Importantly, PFOF is already accruing to customers in the form of zero-commission trades, covering at least a portion of operational costs of customer-facing brokers. While customer-facing brokers are undoubtedly left with a big slice of the economic pie even after providing their basic service for free, any formal calculations of the value of this service, as well as the incorporation of relevant fees for some types of orders or customers, would be contentious. Even if direct monetary payments from off-exchange market makers to customer-facing brokers are absolutely banned, somewhat similar transfers of economic value may take stealthier forms. On a related note, in addition to impacting the existing free or otherwise subsidized services offered by customer-facing brokers to retail traders, any direct or indirect restriction of PFOF would be—in some fashion—reflected via the tradeoff between PFOF and price improvement.

By contrast, a more realistic proposal, which was also articulated during the hearings on behalf of a leading off-exchange market maker, aims at a potential reform of the existing tick size regime with its disparities for different types of trading venues. Likewise, a leading securities exchange has reiterated the need “to harmonize the on and off-exchange price increment regimes.” As another lesson from the European regulatory regime, its sophisticated pricing grid simultaneously applies to quotes, price improvement, and executions of “systematic internalisers,” which could be a transplanted contribution to field-leveling for different types of trading venues. Such a refinement would also address the inherent laxity for price improvement practices of off-exchange market makers vis-à-vis securities exchanges dating back to the adoption of Regulation NMS.

Another promising path to meaningful reforms articulated during the hearings could involve a further refinement of the reporting requirements under Rules 605 and 606, such as more granular / stock-by-stock precision. Another feasible measure is standardized disclosure of key economic terms of order flow arrangements between customer-facing brokers and off-exchange market makers, such as price improvement targets or price improvement / PFOF splits, as these terms are subject to explicit negotiations. Also in the realm of reporting requirements, an additional innovation could tackle the outdated ceiling for reporting off-exchange transactions in FINRA Rule 6380A, which currently stands at “as soon as practicable but no later than 10 seconds.”

As the final item in this non-exhaustive list, a much more difficult task lies in crafting more systematic reforms—or abstaining from them altogether—related to regulatory limits to segmentation and consolidation of different types of order flow, whether on- or off-exchange. Such measures could entail mandatory exposure of retail orders in the lit markets or other forms of competition on an order-by-order basis, and some of them have the potential to disrupt or otherwise impact the value of order flow relationships between off-exchange market makers and customer-facing brokers. The best starting point for this task is a recent whitepaper authored by Hitesh Mittal and Kathryn Berkow of BestEx Research. Additionally, the phrase “inaccessible liquidity,” which captures the concern expressed by many stakeholders and commentators about the sufficiency of interaction of retail and institutional order flow, also surfaced during the hearings. Overall, the ultimate goal of a competitive interaction of orders in today’s fragmented marketplace requires a complex cost-benefit calculus for different types of investors and a holistic review of the current equity market structure as a whole.