“Go ahead. Make my day.”

Harry Callahan

The end of 2022 may not arrive soon enough for stock market investors.

This has been an extremely trying year for all involved, not the least of which for those attempting to maintain traditional portfolio allocations. However, there is potentially one final concern to be made aware of regarding end of year market activity:

As we mentioned in the recent Feed post, “Santa or Grinch? Impacts From The Next Big Option Trade,” the large JP Morgan Hedged Equity Fund has an expiring options position and a corresponding roll which will both take place on December 30th. We focus on this position because it is outsized in the listed index derivatives ecosystem for this – traditionally low liquidity – time of year.

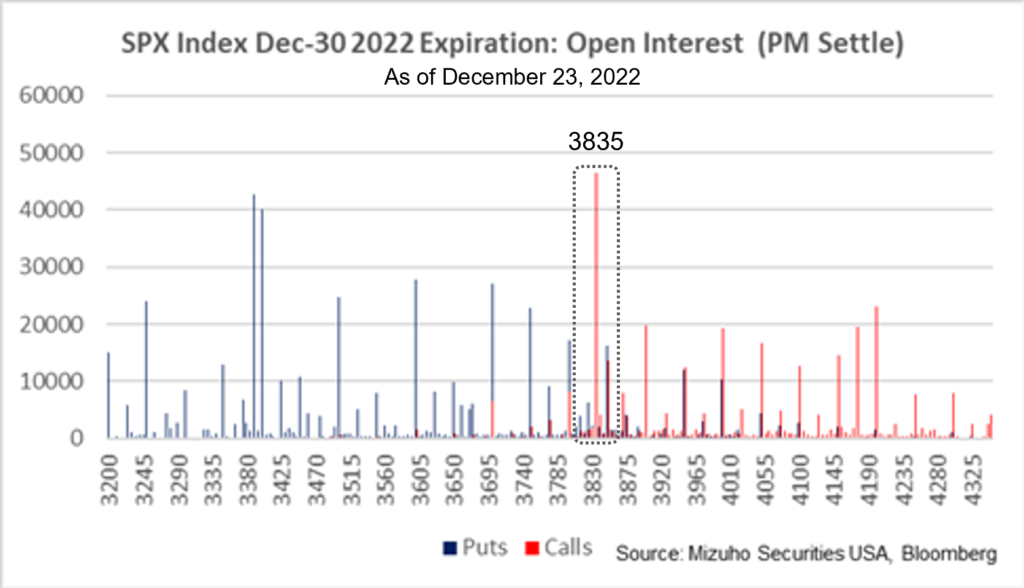

As a recap, we discussed the “magnetic effects” of the highest strike in this fund’s option overlay structure. It’s a 3835 call in a collared put spread structure – where the fund buys an out of the money put spread and simultaneously sells an out of the money call, all with the same maturities and in amounts reflecting the underlying equity exposure owned – with expiration on December 30th.

Since the December 16th monthly expiration, we have also seen the magnetic effects of this large call position create a pull towards the 3835 SPX market level which has increased in influence as the gamma has continued to grow with the passing of time. See chart below (of SPY as proxy for SPX) illustrating the market’s recent “attraction” around the 3835 level:

On December 30th, we are going to witness the release of the gamma effect after this option series expires and the position is rolled to a March end of quarter expiration; a position with significantly less gamma attribution for the time being. The chart below shows open interest for SPX index options for expiration on December 30th, including the outsized open interest for the 3835 call strike:

Bottom line: As if shot out of canon, this expiration and roll could influence an increase in market volatility as soon as the first trading day of the new year.

Are you rested and ready for 2023 yet?!

There is one other small item to share here: The actual roll process into March end, will require some nifty positioning on December 30th to create a temporary hedge for the options component of the fund structure. With the fund’s history as a guide, this temporary hedge will be a deep in the money call. The delta exposure of this call will be established to mimic the exposure of underlying equity in the fund but will expire at the end of December 30th and be replaced by the underlying fund exposure, thus leaving JP Morgan Hedged Equity status quo.

The impacts, if any, are going to be on the dealer side of the equation. The dealer exposures are a unique opportunity to illustrate the skill and timing in managing expiring deltas which can be offsetting – or not – including potentially being additive.

The takeaway is twofold: First, expect the likelihood of more market volatility after this gamma expiry passes. And, second, be wary of potential market impacts from dealers in the final moments of the final trading day of the year.

Beyond that, wishing you and yours a happy New Year…

Don Dale

Curved Edge Strategies

Curvededgestrategies.com