“Illusion is the first of all pleasures.”

Voltaire

There are three factors with unique potential to converge as we head into the end of the year that could amount to a very big option trade impact.

The source of the first factor belongs to one of the most successful option overlay products in the market today; the J P Morgan Hedged Equity Fund (JHEQX). Climbing to $14.8 billion in total assets (as of December 9, 2022) since its launch in 2013, JHEQX’s objective is to “provide smoother equity returns by tempering downside and upside returns via a systematically implemented options strategy,” according to Morningstar. This product has been so successful that JPM launched two “sister” products – JHQDX and JHQTX – that execute their option overlays on alternate expiration cycles to minimize excessive and predictable market impact, as will be demonstrated:

Roughly speaking, JHEQX is an S&P 500 replication strategy with a “twist.” The twist is an option overlay that’s designed to smooth returns by executing a package of options at the end of each quarter. The structure of the option overlay goes like this: Purchase 5% out-of-the-money (OTM) SPX put protection on the underlying portfolio and then “pay” for that (long) put protection by selling both 20% OTM puts and approximately 5% OTM calls. Repeating this overlay quarterly is known as a “roll.” The next quarterly roll occurs on Friday, December 30; the last trading day of 2022. Once we pass the Friday December 16 expiration – which applies to regular monthly options – the December 30 expiration will play a much bigger role.

The source of the second factor is the traditionally low liquidity that occurs during trading sessions that fall between Christmas and New Year’s Day.

Given this fund’s eight-year track record, there have been many quarterly option rolls over its lifespan. 31 to be exact. And all the roll periods don’t result in market-moving events. But, the reason that the next roll may create a market-moving event is the fact that the S&P 500 index (SPX) is currently trading within close range of an SPX 3835 call option with high open interest originating from JHEQX. This is the third factor.

If these three factors – large option roll, low liquidity period, and potential for a “pegged” strike price – converge, there are likely to be market impacts.

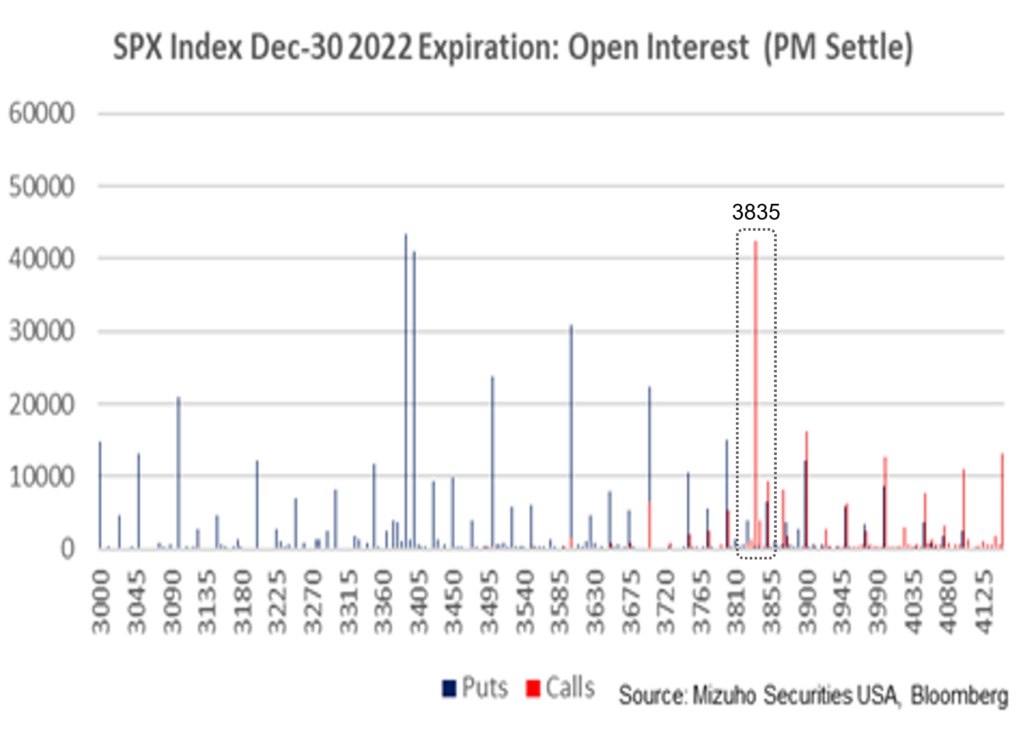

Note the disproportionately large open interest on the 3835 strike calls versus all other strikes near our current market level (~3896 close, as of December 15, 2022), below:

Now let me explain the implementation process for a quarterly roll. This will illustrate the potential market impacts during these important dates – after December 16 and leading up to December 30 – and why the moves can be exacerbated this time of year by liquidity distortions.

These options are structured in amounts that represents the underlying size of the fund; approximately $15 billion notional. This works out to roughly 40,000 SPX options; the current exposure at the time of the roll. 40,000 x 3835 x index option multiplier of 100 = $15 Billion.

At the end of this past September, JHEQX rolled to new December 30th strikes. The strike that is most relevant to this discussion is the upside call option which is 3835 strike and given the substantial market movement since the roll date.

This call was sold by JHEQX to dealers which as of this writing are still part of open interest. This position creates a pull towards this strike that becomes stronger the closer SPX is to this level, and if close, continues to increase as more time passes and we get close to the maturity.

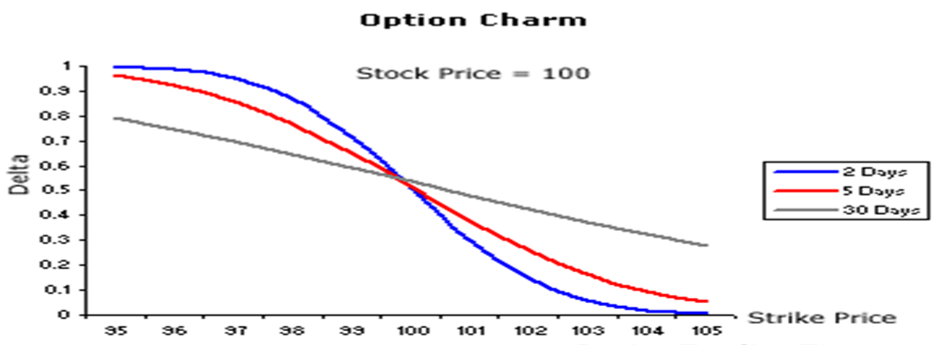

This phenomenon is a function of the option greeks. All options experience decay or theta. Decay is the evaporation of the options premium over the intrinsic value of the option. Theta decay increases its pace with the passage of time and accelerates the closer to expiration. While this passage of time is transpiring, the other greeks of the option are changing dynamically as well. Primarily, the delta is moving towards either 0 or 100. The option delta is realizing the increased probability of it being out of the money at expiration with a 0 delta, conversely, in the money and the strike below the current market for a call which results at expiration with a delta of 100 which is the current case.

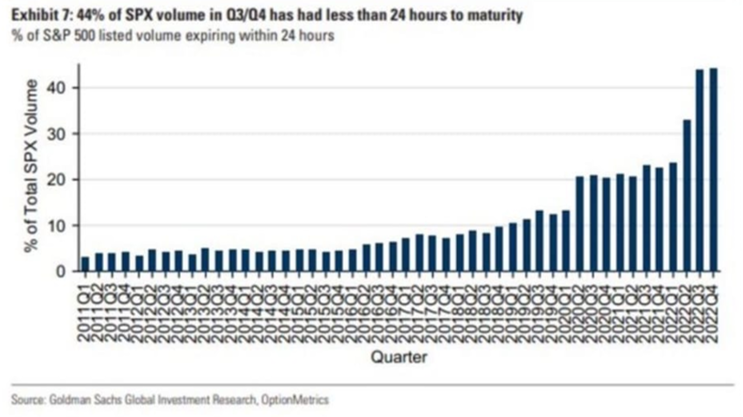

The option market refers to the dynamics of this delta shift over time with the harmless sounding term “charm.” Charm has become a much bigger and more frequent market impact factor in recent years as the focus of traded options have migrated to shorter dated exposures. See below:

Because the dealers are long this 3835 call option, the impact of the market close to but above this strike will cause these dealers to sell deltas as the market stays above the strike – and as we move closer to expiration on December 30th. Prior to the December 16th regular monthly expiration there should be a muted impact from the December 30th positions as there is substantial open interest in a variety of strikes on the December 16th expiration date that should supersede any charm effects from end of the month expiration. The issue can become pronounced just after the 16th expiry as there is currently little else to deflect greek impacts for the rest of the month.

It should be noted here that this “magnetism” also works in the other direction if the market finds itself below the 3835 level after December 16th. The dealers are long the gamma of this option. As we move forward in time they will need to offset the dynamics of the changing greeks by buying deltas in the market.

To summarize: Large open interest in a specific option strike acts like a magnet. This magnetism increases 1) the closer the underlying price (in this case S&P500 index) is to that specific option strike, and 2) the closer we are in time to the expiration date. Dealer delta hedging is often the cause of this magnetism.

There are additional concerns regarding JHEQX which could develop – and cause market impacts – at the very end of the final trading day of 2022 if circumstances are ripe during the actual rolling and replacing of the existing positions. We can discuss this later in the month.

Don Dale

CURVED EDGE STRATEGIES

don@curvededgestrategies.com